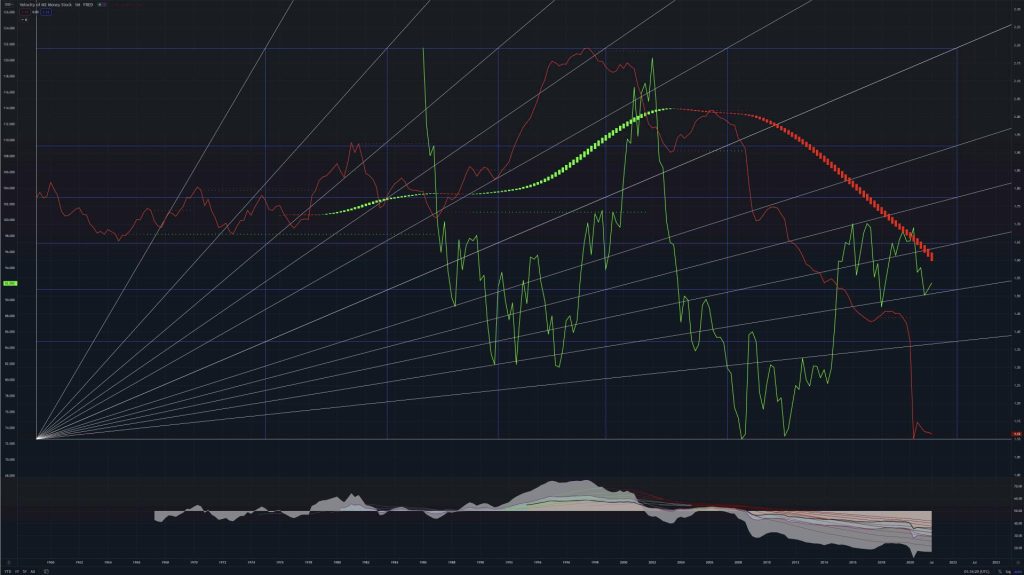

The above Image is a chart of Velocity of M2 Money(RED line) and the Dollar index(GREEN line) overlayed with each other and mapped with a trend and time drawing tool(angled white lines and blue grid). The wavy green and red line is a moving average indicator. The indicator at the bottom of the chart is a multiple timeframe relative strength index.

What you are looking at is a current mapping of a large cycle of money velocity dating back to 1959 and the dollar index data becoming available in 1986. The drawing tool used to map the price is valid to visually inspect the interaction with both the dollar and the money velocity at the same time. Here is the logic that is involved with the relationship between these 2 data points; Increasing money velocity signifies more cash moving through the economy. Decreasing signifies cash movement slowing. How aggressive the movement is will determine how deep and strong it affects things. In addition to this, you will have leading and lagging effects in the economy based on prior money velocity dynamics and dollar value relationship.

If you examine the chart, you will notice that before the dollar drops in value, the money velocity usually had a prior move up. The longer and higher the move up, the higher the dollar will move when the money velocity moves down. As mentioned in the above paragraph, the aggression of moves and the leading and lagging effects in the economy will determine what happens next. In short, how deep and strong the following implications may be. Combine the aggression of money velocity and the time it takes for aggression to increase or decrease in any direction will determine how aggressive the next move of the dollar will be. When the dollar moves up, the markets tend to sell off to remove risk. When the dollar drops, the markets tend to take on risk, causing prices to rise. This is not a 100% linear relationship, but the relationship is always there. It is just a matter how how severe the financial structure has been changing aggressively.

These economic undulations are well known by top financial experts and the ultra rich. They look at the past and future and simply maintain their balance on a global sized see-saw, which is what makes them successful.

They look at the financial and economic changes that occur near prior significant historic levels and make informed decisions as deemed appropriate. The lower class of the population tends to go along with stories and narratives sewn by the elite class to influence the next stages of economic behaviors. And we should all know by now, that in order to sell a lie, you will speak with 90% truth. In fact, you can include time as a % function as well. Tell a truth or convincing truth for 90% of the timeline you expect to use before spreading your lie. If you look at the money velocity, the major all time low historic crash is but 10% of the prior history it has. Now is the time where the great lies spread far and wide, affecting the population by the billions. It is a rather simple psychology, but the lust for instant gratification has subdued all but the more brighter minds.

There is a decision that the few brighter minds living today can make. That decision ought to be to not manage your financial future against the interests of those who facilitate the majority of economic directions and cycles. In other words, do not bet against the Fed unless you are going to directly change their policies. Money printing is what will be highly aggressive over the next decade in order for America and the world economy to facilitate the money velocity to make an attempt to get back to prior or sustainable historical levels. It will be a massive attempt to fix the economy that will fail, and we know what tools the Fed, Treasury and Congress tend to resort to(Refer to statements made by the Federal Reserve about the “tools” they have). To be fair, “fail” does not mean the end of the Federal Reserve or government. It just means the current “tools” will fail. And history has told us for thousands of years that these global elite have an unlimited amount of tools to experiment with on an ever-forgetting population.

The markets will skyrocket as fiat craters and seeks refuge in assets with the expectation of appreciation or stability. Precious metals, stocks, cryptocurrencies, etc will all see a much more explosive move higher than what has already been seen. Many financial analysts are calling for a complete dollar collapse. This is currently unrealistic. The dollar has already collapsed multiple times and simply gets a new name job and returns as if nothing happened. And the tools to manage the value of fiat have gotten more sophisticated. The dollar will return to it’s all time highs. The Fed will ensure there comes a crisis where the world rushes back to the dollar. And people who study the fringes of these kinds of subjects know very well that mass casualties are often associated with major economic transformation. This is what is coming. “Transformation”, not collapse. The ball is in the court of the masses at this point. They must transform themselves, or the elite will transform them.

Since between 2008 – 2011, the money velocity failed to maintain above the historical range it has spent prior to that time. It will make a strong move back up, at least for a short period of time. It is during this time which is happening NOW at the end of 2021 and leading through 2023 where the velocity of money will skyrocket. This will crush the dollar in the short term. So now is the time to secure your financial future! Crypto will make you the most money, but precious metals like gold and silver will also perform well. Same with stocks. Make your own choices. Just know that these cycles will never end until the masses decide to reclaim their destiny.

Expected percentage increases in the markets will likely see 50 – 40,000% gains over the next 2 years across all kinds of assets. If you find yourself significantly up in profit, do not make the same mistake as others who become greedy and blind at the top of a bubble and fail to sell the top, or act even worse by buying the top. If the markets look bottomed out as they currently do at the time of this article being written, thats where you want to buy.

There is great hope in our futures and the last thing you want to do is be financially illiterate. Be responsible. Save yourself in the best way you see fit, so that you can help others in need.